The Ultimate Guide to R404A Refrigerant Price in 2025

Why R404A Refrigerant Pricing Matters for Your Business in 2025

R404a refrigerant price has become a critical budget consideration for funeral home directors as regulatory changes and supply constraints drive costs higher than ever before. Here's what you need to know right now:

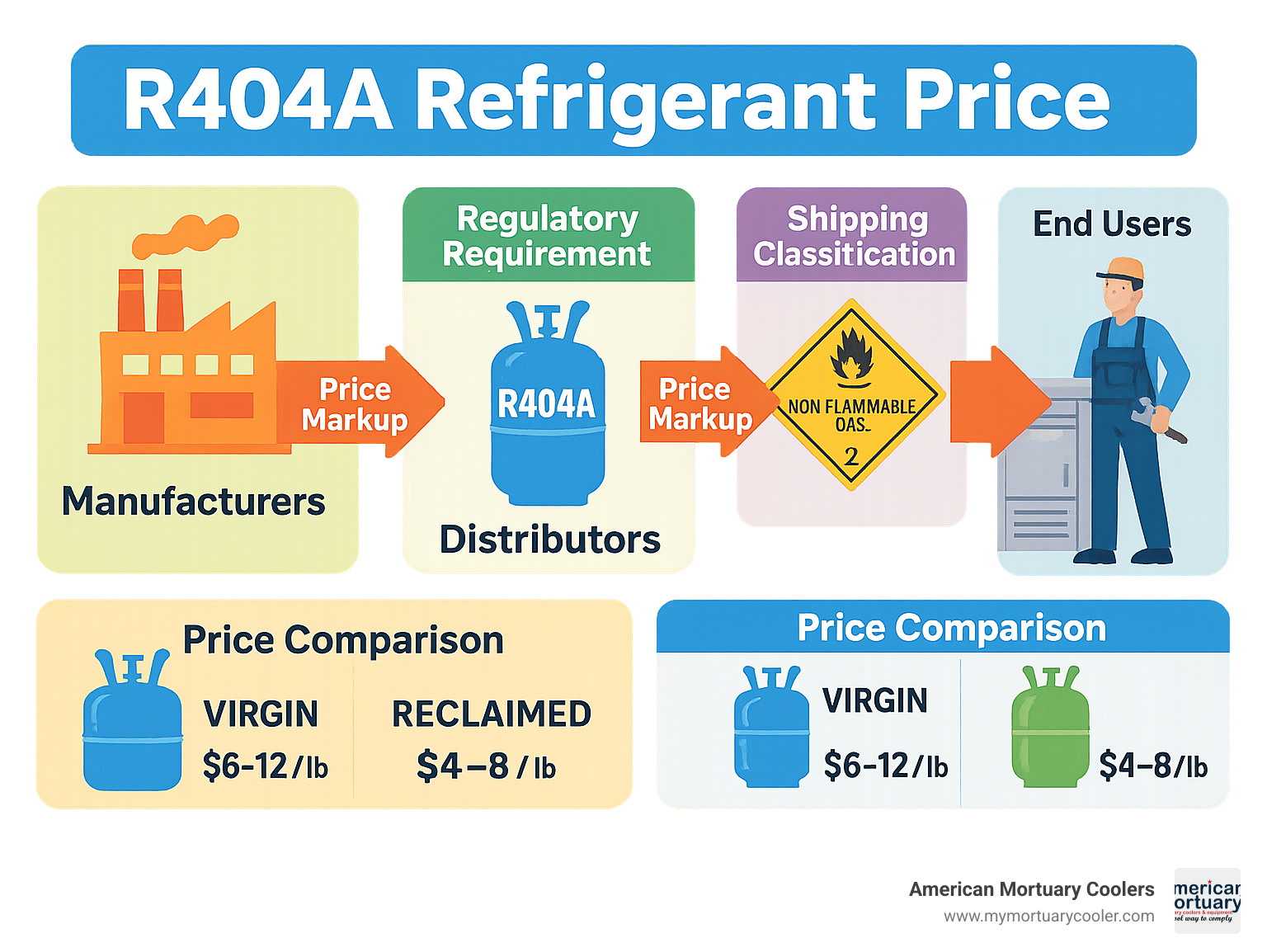

Quick R404A Price Reference:

- Per pound: $6-12 (varies by supplier and quantity)

- 24 lb cylinder: $365-469 retail

- 100 lb cylinder: $3,750 wholesale

- Additional costs: $30-60 shipping, hazmat fees, cylinder deposits

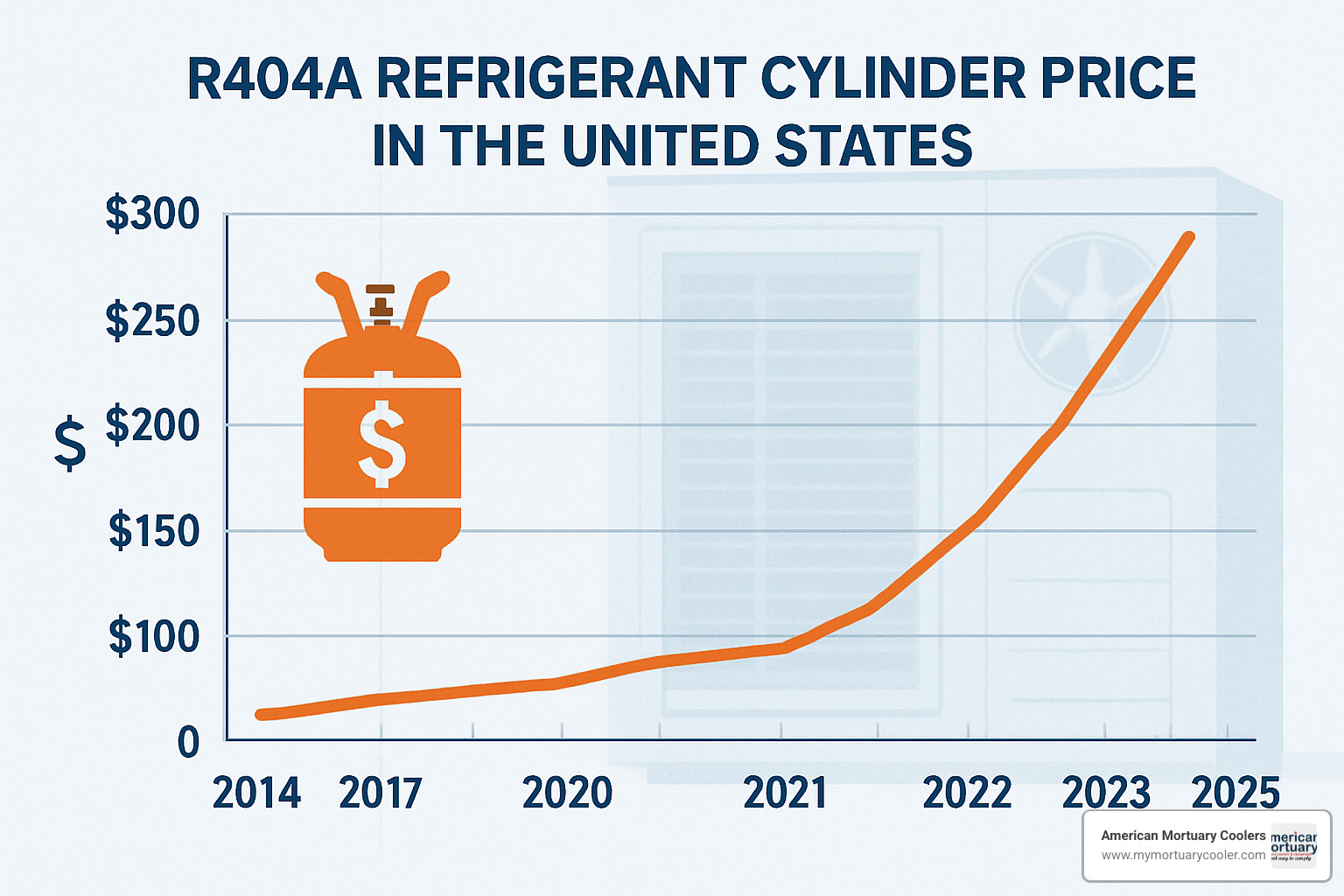

- EU comparison: Prices increased 9.6x since 2014 due to quota restrictions

The refrigerant that keeps your mortuary coolers running has seen dramatic price swings due to EPA phasedown quotas, state-level restrictions, and the shift toward lower global warming potential alternatives. In California and New York, new rules starting January 2025 require reclaimed R404A for existing equipment service, adding another layer of complexity to procurement decisions.

Understanding these price drivers isn't just about managing costs - it's about ensuring your facility can maintain proper temperature control without budget surprises. From hazmat shipping requirements to EPA certification needs, every aspect of R404A purchasing has compliance implications that affect your bottom line.

I'm Mortuary Cooler, a national-level mortuary cooler supplier with extensive experience helping funeral homes steer r404a refrigerant price fluctuations and regulatory changes. This guide will give you the tools to make informed decisions about R404A procurement and explore alternatives that might save money long-term.

R404a refrigerant price further reading:

What Exactly Is R404A & Why It Still Matters in 2025

R404A is a blend of three refrigerants: R-125 (44%), R-143a (52%), and R-134a (4%). This combination creates a "zeotropic blend" with excellent cooling performance but a high Global Warming Potential (GWP) of 3,922.

R404A just works incredibly well for mortuary coolers, supermarket refrigeration, and truck reefers. It replaced older refrigerants like R-502 and R-22 because it delivers excellent cooling power in low and medium-temperature applications. The refrigerant earned an A1 safety classification, meaning it won't catch fire and isn't toxic to humans.

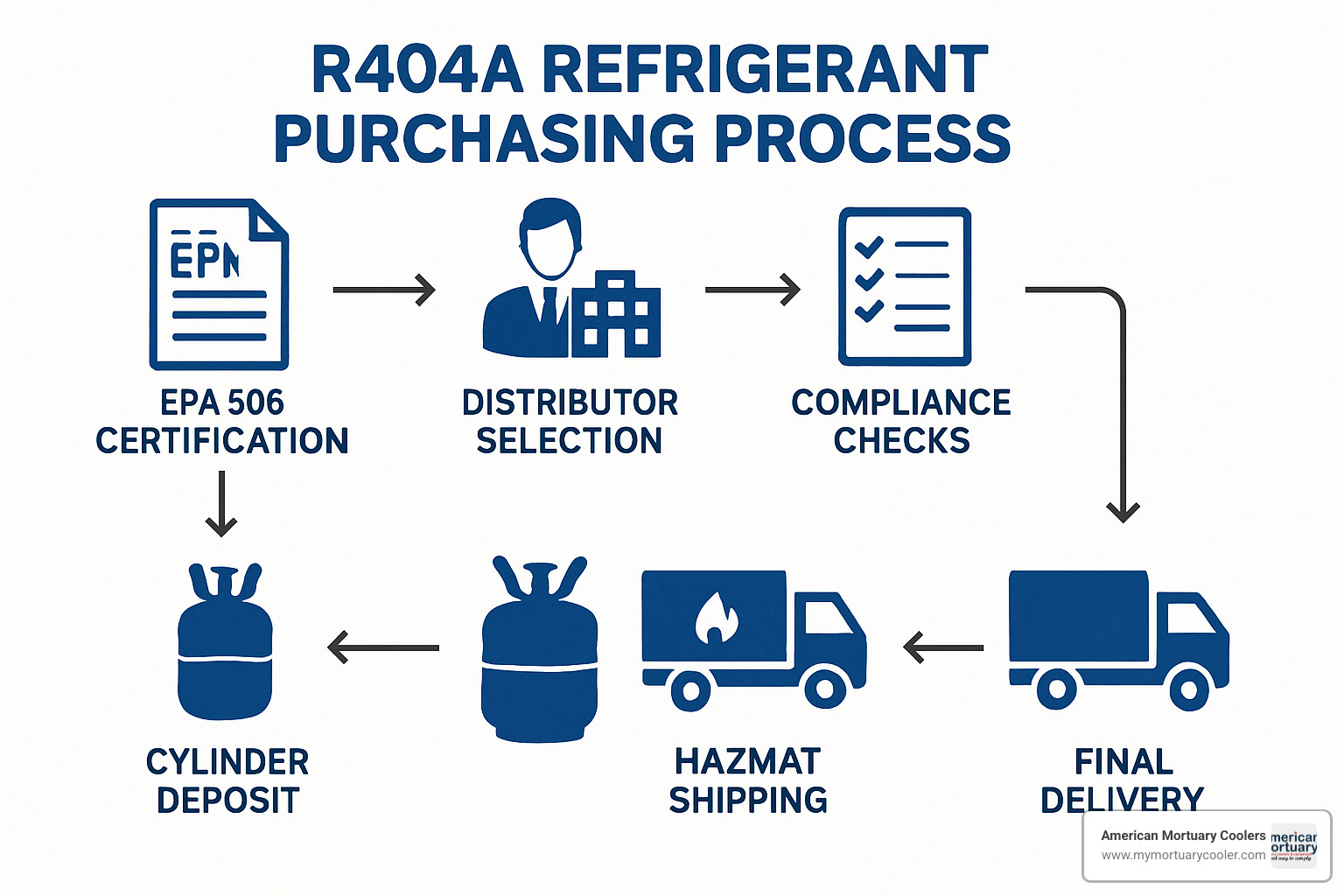

EPA Section 608 regulations control who can buy R404A. Anyone purchasing more than 2 pounds needs proper certification - no exceptions. The SNAP rules continue evaluating where R404A can still be used legally, with acceptable applications shrinking each year.

More info about Refrigeration System basics

R404A Properties & Performance Basics

The zeotropic nature means the three components have different boiling points. When the blend changes from liquid to gas, you get "temperature glide" - a gradual transition that actually improves heat transfer in many applications. This makes R404A particularly effective in mortuary coolers where consistent temperature control matters most.

Service technicians appreciate that R404A doesn't require exotic tools or extensive safety equipment. However, the blend must be charged into systems as a liquid, not vapor. If you charge it as vapor, the components separate and you lose the carefully balanced performance.

A Practical Guide to Finding a PT Chart for R404A Refrigerant

Key Regulations Shaping Use

The EPA's AIM Act established HFC phasedown quotas targeting an 85% reduction from baseline levels by 2036. These quotas create artificial scarcity as allowances become more valuable than the actual refrigerant.

California's CARB and New York's DEC have gone even further. Starting January 1, 2025, both states require reclaimed R404A for servicing existing equipment. You can't use virgin refrigerant for maintenance work anymore.

The small-can exemption allows purchases under 2 pounds without EPA 608 certification, but that doesn't help when your mortuary cooler needs a full system charge. Canadian facilities need Halocarbon permits for R404A purchases, adding bureaucratic delays and costs.

R404A Refrigerant Price Snapshot 2025 — Current Numbers & Quick Reference

Let's cut straight to the numbers you need for budgeting your mortuary cooler maintenance. The r404a refrigerant price in 2025 has settled into what I'd call "the new expensive normal" - and understanding these costs upfront can save you from sticker shock when your service tech presents the bill.

Here's the reality: what looks like a $365 cylinder online often costs over $500 when it arrives at your door. Between hazmat shipping fees, cylinder deposits, and regional markup, the true cost adds up fast. This isn't your supplier trying to gouge you - it's the new market reality shaped by EPA regulations and supply constraints.

Recent market data shows distributor prices jumped 18% in Q4 2024 compared to the same period in 2023. That follows years of steady increases as HFC phasedown quotas bite harder each year. The European market offers a glimpse of our future - their prices have increased nearly 10 times since 2014 under stricter regulations.

The good news? Prices have somewhat stabilized after the wild swings of recent years. The challenge is that they've stabilized at these higher levels, making accurate budgeting more critical than ever.

2025 r404a refrigerant price per pound

Breaking down the r404a refrigerant price per pound helps you compare options and spot the best deals. Current pricing ranges from $6 to $12 per pound, but the devil's in the details.

Online retail pricing typically runs $8-12 per pound for small quantities. This includes the convenience premium of ordering a single cylinder when you need it. For funeral homes that only need refrigerant occasionally, this might be your most practical option despite the higher per-pound cost.

Wholesale pricing drops to $6-8 per pound for larger quantities, but requires establishing accounts and meeting minimum orders. If you operate multiple coolers or work with other funeral homes in your area, wholesale buying can deliver significant savings.

Technician markup often reaches $15-25 per pound, but this includes proper installation, system diagnosis, and warranty coverage. While it seems expensive, a skilled tech can prevent costly mistakes that DIY refrigerant additions sometimes create.

Shipping costs can add $6+ per pound to small orders. A $150 hazmat shipping charge on a 24-pound cylinder suddenly makes that "cheap" online price much less attractive.

Average r404a refrigerant price per cylinder

Cylinder pricing varies wildly based on size and supplier, so let's break down what you'll actually pay in 2025.

24-pound cylinders represent the sweet spot for most mortuary operations. Online retail pricing runs $365-469 for virgin refrigerant, while major distributors charge around $900 wholesale. Don't forget the hidden costs: $30-60 shipping, $50-200 cylinder deposits, and applicable taxes.

25-pound wholesale cylinders from major suppliers typically cost around $900, offering slightly better value than retail 24-pound options. The extra pound doesn't sound like much, but it can make the difference between completing a repair or needing a second cylinder.

100-pound cylinders wholesale for approximately $3,750, delivering much better per-pound value for high-volume users. However, these require proper handling equipment and storage facilities that many funeral homes lack.

European pricing provides insight into our regulatory future. A 10.9 kg cylinder (roughly equivalent to 24 pounds) currently costs €480-550, with complex deposit structures adding €80-200 depending on terms.

The cylinder size decision affects more than just upfront cost. Larger cylinders offer better economics but require proper storage and handling equipment. For most funeral homes, 24-pound cylinders balance cost-effectiveness with practical handling requirements.

U.S. vs. Europe price gap & key stats

The price gap between U.S. and European markets tells the story of where our r404a refrigerant price is heading. European funeral homes operating under stricter F-Gas regulations since 2014 are living our regulatory future.

European distributor costs have increased 9.6 times since 2014 for some refrigerants, while end-user prices have risen 3.0 times over the same period. This shows how supply chain markups compound as quotas create artificial scarcity. U.S. prices haven't reached these extremes yet, but the trend is clear.

Exchange rates complicate direct comparisons, but the European experience shows how quickly prices can escalate under quota systems. In Q4 2024, EU quota authorizations traded at €15.9 per ton CO₂-equivalent, representing a significant cost component that doesn't yet exist in U.S. pricing.

The recycled refrigerant market offers hope for cost control. European recycled R404A commanded 97% of virgin refrigerant pricing in Q4 2024, suggesting strong demand for all forms of the refrigerant as new production becomes constrained. This pricing parity makes reclaimed refrigerant an attractive option where regulations permit its use.

For American funeral homes, these European trends suggest that current pricing levels may be the "good old days" rather than a temporary spike. Planning for continued price increases makes sense as our regulations tighten to match European standards.

Latest research on refrigerant prices

Why R404A Prices Fluctuate — 6 Core Drivers to Watch

Six major forces shape r404a refrigerant price fluctuations. The HFC phasedown creates the biggest long-term pressure, while quota scarcity adds artificial supply constraints. Feedstock costs for chemical components fluctuate with energy markets and raw material availability.

Logistics and hazmat surcharges have worsened since the pandemic, with driver shortages and fuel costs hitting refrigerant shipments hard. The growing reclaimed supply market creates its own pricing dynamics as recovered refrigerant becomes more valuable. Finally, alternative demand pull affects R404A pricing as facilities weigh switching costs against rising refrigerant expenses.

Impact of 2024-2025 HFC Quota Cuts

The EPA's quota system has fundamentally changed how r404a refrigerant price gets determined. The 85% baseline reduction target by 2036 means less R404A gets produced each year, regardless of market demand.

Companies can trade these quota allowances like commodities. If a manufacturer needs more production rights, they bid against competitors in auction prices that directly affect what you pay at the cylinder level. When allowance costs go up, refrigerant prices follow.

What this means for your facility is that R404A costs are partially disconnected from traditional manufacturing economics. Even if production costs stay stable, quota expenses can drive prices higher.

Supply-Chain Bottlenecks & Shipping Fees

Cylinder deposits that used to be $50 are now $150-200 in many cases. Ocean freight costs have created chaos for imported refrigerants and chemical components. Container shortages, port congestion, and shipping rate increases all get built into the final price you pay.

The hazmat carrier premiums represent a growing problem. Not every trucking company can handle refrigerant shipments, so you're dealing with a limited pool of carriers. Driver shortages in the hazmat sector mean those carriers can charge premium rates.

Environmental Policies & State Rules

State-level regulations are fragmenting the national R404A market. California self-contained ban rules prohibit R404A in new equipment, while the reclaimed-only servicing requirement creates a two-tier market where virgin and reclaimed refrigerant have different availability and pricing.

SNAP 21 evaluations by the EPA continue to restrict acceptable uses for R404A. Each new restriction shrinks the addressable market, but it doesn't immediately reduce the installed base of equipment that needs service.

Buying R404A in 2025: Hidden Costs, Compliance & Negotiation Tips

When shopping for r404a refrigerant price quotes, that cylinder price is just the tip of the iceberg. The real cost includes shipping, deposits, taxes, and compliance requirements that can easily double your expected expense.

The shipping classification for R404A as a Class 2.2 hazardous material automatically adds $30-60 to every shipment. Then there's the cylinder deposit - typically $50-200 per cylinder - which ties up your cash flow until you return the empty container.

Your EPA 608 certification determines where and how you can buy refrigerant. Without proper certification, you'll need to work through contractors who add their markup but provide valuable expertise.

Calculating True Landed Cost

Smart buyers calculate the total delivered cost rather than just comparing cylinder prices. Start with your base cylinder cost, add your hazmat shipping fee of $30-60, factor in the cylinder deposit of $50-200, and don't forget sales tax of 6-10%.

Let's look at a real example for a 24-pound cylinder. You see a cylinder listed for $400. Add $45 for shipping, $100 for the cylinder deposit, and $32 in sales tax (8%). Your total landed cost becomes $577, which works out to about $24 per pound - quite different from that initial $400 price tag.

Certification & State Restrictions Checklist

Federal requirements start with EPA 608 certification for anyone buying more than 2 pounds of refrigerant. State-specific rules are becoming more complex. California now requires reclaimed R404A only for servicing existing equipment starting in 2025.

Documentation needs include your resale certificate for distributor purchases, hazmat shipping papers that require signatures, and system service records for compliance audits.

How to Negotiate Better R404A Refrigerant Price

Bulk purchase agreements work even for modest volumes. Committing to just 4-6 cylinders annually can often open up wholesale pricing tiers. Off-season buying takes advantage of demand cycles - purchase during fall and winter months when suppliers offer better pricing.

Service bundling creates win-win situations. Combine refrigerant purchases with maintenance contracts, and contractors often provide better refrigerant pricing when they're guaranteed ongoing service work.

Shop R404A Refrigerants – URI

Alternatives, Retrofits & Future Outlook Beyond R404A

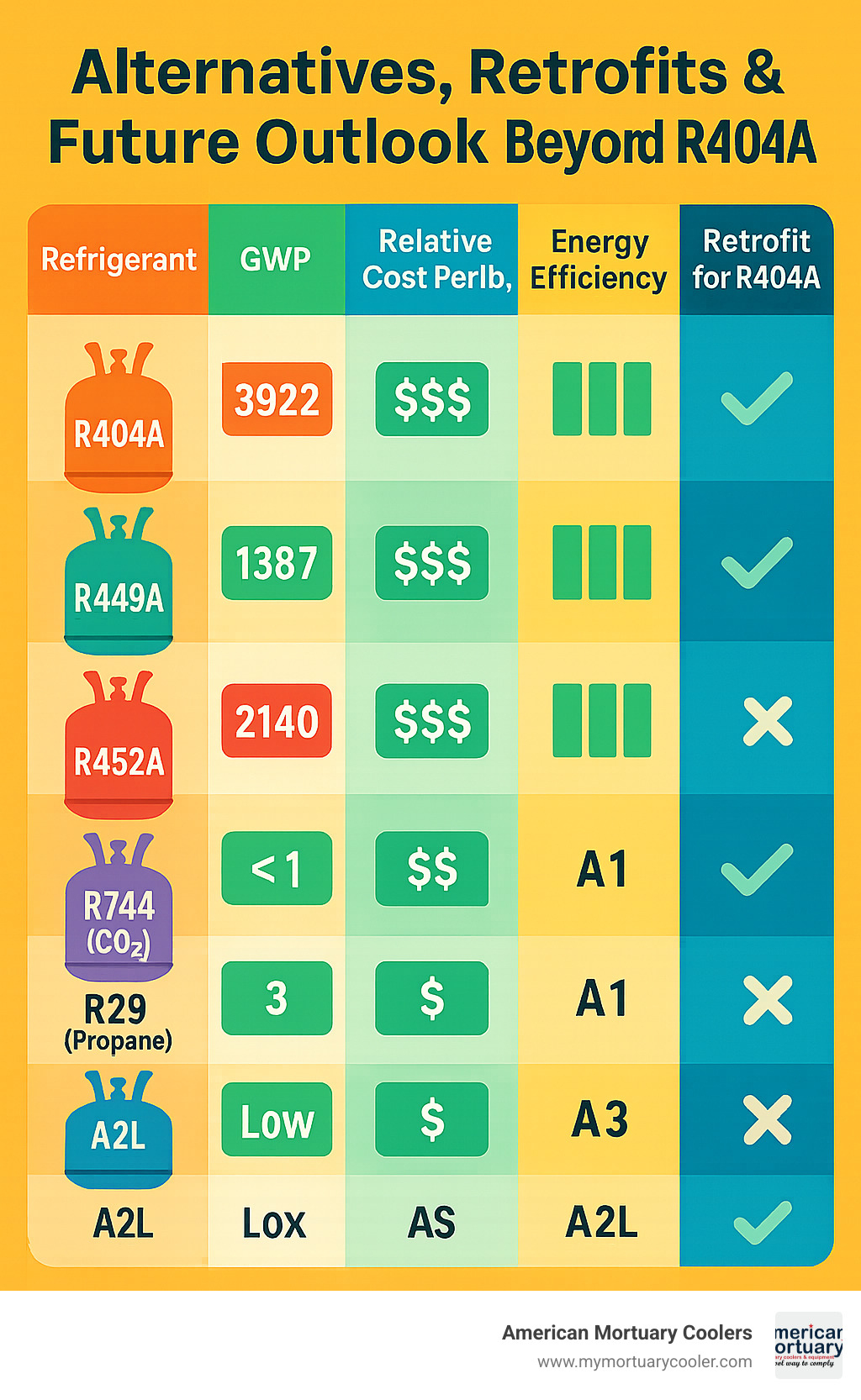

Rising r404a refrigerant price has many funeral home directors asking: "When should we switch to something else?" Several solid alternatives exist, each with different benefits and trade-offs for mortuary cooling applications.

R448A and R449A stand out as the most straightforward replacements for existing R404A systems. Both offer dramatically lower global warming potential (1387 and 1397 respectively, compared to R404A's 3922) while delivering similar cooling performance. What makes these particularly attractive is their retrofit-friendly nature.

R452A brings even better environmental credentials with a GWP of 2140. Natural refrigerant options like R744 (CO₂) and R290 (propane) offer incredible environmental benefits with ultra-low GWP ratings but typically require complete system redesigns.

A2L refrigerants such as R454C represent the cutting edge with GWP ratings under 150. These "mildly flammable" refrigerants require updated safety protocols but deliver excellent performance with minimal environmental impact.

Price Comparison: R404A vs Leading Substitutes

R448A currently runs about $420-480 for a 25-pound cylinder - a slight premium over R404A, but the retrofit-friendly nature often makes the total transition cost lower. R449A pricing sits in a similar range at $430-490 per cylinder.

R452A typically costs less at $380-450 per cylinder. The natural refrigerants show dramatic price differences: R744 costs only $150-200 per cylinder, while R290 runs just $80-120.

The real calculation isn't just about cylinder costs - it's about energy efficiency, system modifications, and technician training. Many alternative refrigerants deliver better energy performance than R404A, which can offset higher initial costs through reduced electricity bills.

Market Forecast to 2030

R404a refrigerant price will likely remain liftd through 2030 as the EPA's quota system creates permanent supply constraints. Equipment manufacturers are already shifting away from R404A in new products.

By 2030, we expect most new mortuary cooler installations will use either HFO blends like R448A/R449A or natural refrigerants like CO₂. Existing R404A systems will continue operating but with higher service costs and longer lead times for refrigerant procurement.

The key is starting your transition planning now, even if you don't implement changes immediately.

Frequently Asked Questions about R404A Refrigerant Price

Is R404A still legal to buy in 2025?

Yes, you can still legally purchase R404A in 2025, though the rules are getting tighter each year. The EPA hasn't banned R404A outright - they're just making it harder to get and more expensive through their phasedown program.

The biggest change this year affects California and New York customers. Starting January 2025, these states only allow reclaimed R404A for servicing existing equipment. You can't use virgin (new) refrigerant for maintenance work anymore. This creates a two-tier market where reclaimed product actually costs almost as much as new refrigerant.

You'll need EPA 608 certification to buy anything over 2 pounds. This isn't negotiable - suppliers won't sell to you without proper certification. The small cans under 2 pounds don't require certification, but they're not practical for mortuary cooler service.

For our customers operating mortuary coolers, this means working with certified technicians or getting your maintenance staff properly certified. It's not just about following rules - it's about ensuring you can get the refrigerant you need when your equipment needs service.

Why does my contractor quote double the posted cylinder cost?

This frustrates a lot of facility managers, but there's solid reasoning behind contractor pricing. When you see r404a refrigerant price listed at $8-12 per pound online, but your contractor quotes $20-25 per pound, you're not getting ripped off - you're paying for professional service.

The contractor's price includes proper refrigerant recovery from your system before adding new refrigerant. They can't just dump the old stuff - EPA regulations require proper recovery and disposal. This process takes time and specialized equipment.

System diagnosis and proper charging add significant value. R404A must be charged as a liquid to prevent fractionation, and the system needs proper evacuation and leak testing. A contractor who just dumps refrigerant into your system without these steps will cost you more money long-term through poor performance and premature failure.

Insurance and warranty coverage protect your investment. When something goes wrong with a DIY refrigerant purchase, you're on your own. Professional contractors carry liability insurance and typically warranty their work, giving you recourse if problems develop.

The markup also covers the contractor's overhead - EPA certification maintenance, specialized tools, hazmat handling procedures, and business insurance. While the per-pound cost seems high, the total cost of ownership often favors professional service.

Should I switch to a lower-GWP refrigerant now or wait?

This decision depends heavily on your equipment's age and condition. For mortuary coolers over 15 years old, transitioning during equipment replacement makes the most financial sense. You avoid retrofit costs and get modern equipment designed for lower-GWP refrigerants.

Newer equipment in good condition might benefit from retrofitting to R448A or R449A. These alternatives offer similar performance to R404A with much lower environmental impact. The retrofit process is usually straightforward, though it requires proper system evaluation and technician expertise.

Don't rush the decision without proper evaluation. Mortuary cooling has unique requirements that not all alternative refrigerants handle well. The consequences of temperature control failure in your application are too serious to risk with an improper refrigerant choice.

Consider your local regulations when making this decision. California and New York facilities face tighter restrictions that may accelerate transition timelines. Other states will likely follow similar paths, making early planning valuable.

The r404a refrigerant price trend clearly points upward as quotas tighten. However, rushing into an inappropriate alternative could cost more than paying premium prices for R404A. Work with qualified technicians who understand both mortuary applications and alternative refrigerants to make the right choice for your facility.

Conclusion

Managing r404a refrigerant price in 2025 feels like navigating a perfect storm of regulations, supply shortages, and market uncertainty. But here's the thing - understanding these forces gives you the power to make smart decisions that protect your facility's budget and operations.

We've covered a lot of ground together, from the $6-12 per pound pricing reality to those sneaky hidden costs that can turn a $400 cylinder into a $600 surprise. The regulatory maze of EPA quotas, California's reclaimed-only rules, and state-by-state variations isn't getting simpler anytime soon. If anything, the 85% quota reduction by 2036 guarantees that r404a refrigerant price pressure will only intensify.

The funeral service industry can't afford temperature control failures. Your families depend on you maintaining dignity and proper care, which means your mortuary coolers must work flawlessly. While lower-GWP alternatives like R448A and R449A offer promising futures, any transition needs careful planning with qualified technicians who understand mortuary applications.

At American Mortuary Coolers, we've seen how refrigerant challenges affect funeral homes across Tennessee, Atlanta, Chicago, Columbia, Dallas, Los Angeles, New York, and Pittsburgh. The facilities that weather these changes best are the ones that plan ahead, build relationships with knowledgeable suppliers, and invest in proper maintenance.

Your refrigerant strategy isn't just about managing costs - it's about ensuring operational reliability when families need you most. Whether you're stretching your current R404A investment or exploring alternatives, staying informed about market trends and regulatory changes keeps you ahead of supply disruptions and budget shocks.

The refrigeration industry's shift toward environmental responsibility creates both headaches and opportunities. Forward-thinking facility managers who accept this transition thoughtfully will find themselves with more reliable, efficient systems and better long-term cost control.